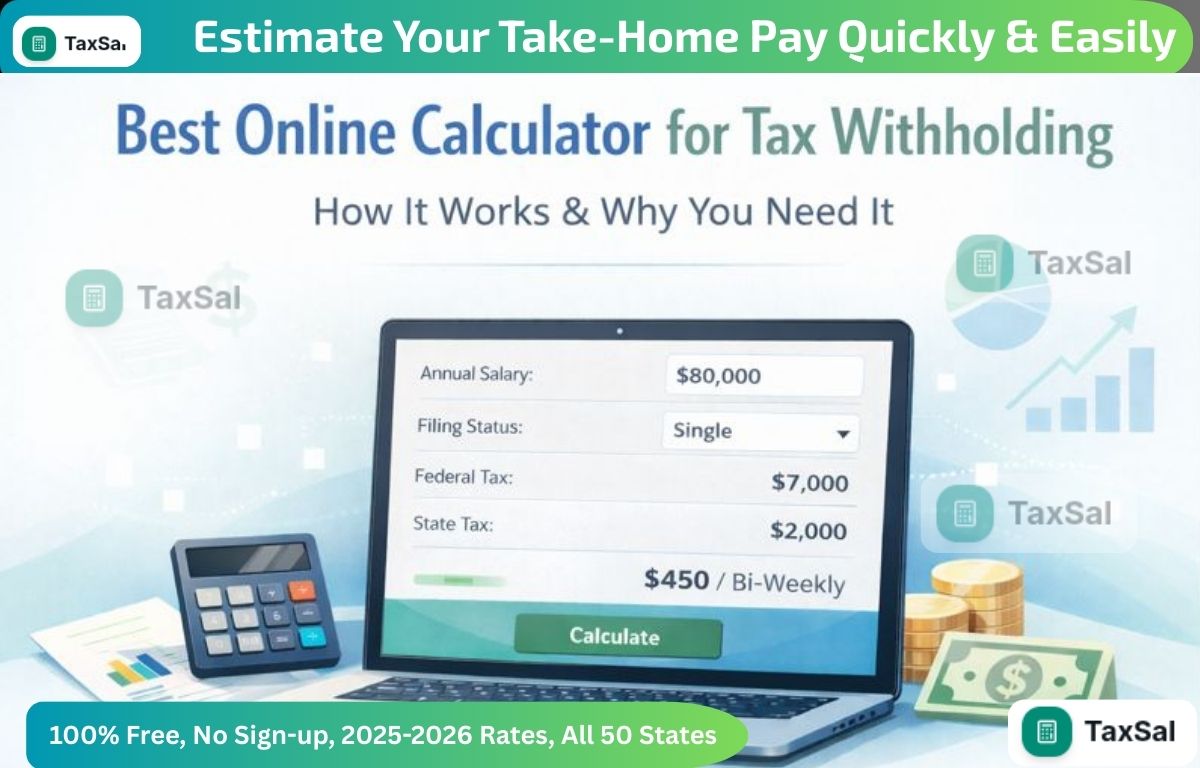

Best Online calculator for tax withholding - How It Works & Why You Need It

Use our calculator for tax withholding to estimate how much tax will be deducted from your paycheck and plan your finances accurately.

The term "withholding tax" refers to the money that an employer deducts from an employee’s gross wages and pays directly to the government. The amount withheld is a credit against the income taxes the employee must pay during the year.

The vast majority of people who are employed in the United States are subject to tax withholding. calculator for tax withholding Nonresident aliens are also subject to withholding taxes on earned income as well as on other income, such as interest and dividends from the securities of U.S. companies that they own.

Check Now: calculator for tax withholding

How Withholding Tax Works

Tax withholding is a way for the U.S. government to maintain its pay-as-you-go (or pay-as-you-earn) income tax system. This means taxing individuals at the source of income rather than trying to collect income tax after wages are earned.

The Mechanics

Whenever an employee gets paid, their employer withholds a certain percentage of their paycheck as income tax. This is then paid by the employer to the Internal Revenue Service (IRS).

The amount deducted appears on the employee's paystub and the total amount deducted annually can be found on Form W-2: Wage and Tax Statement. Employers send W-2s to their employees each year to help them file their annual income tax returns.

The amount deducted depends on a number of factors. These considerations include the amount an employee earns, filing status, any withholding allowances claimed by the employee, and whether an employee requests that additional income be withheld. If merited, any excess is paid back to the employee by the IRS as a tax refund.

Special Considerations

The majority of U.S. states also have state income taxes and employ tax withholding systems to collect taxes from their residents. States use a combination of the IRS Form W-4 and their own worksheets, which residents fill out to establish their withholding.

Eight states don't impose income tax on residents. They are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, and Wyoming.

History of Withholding Taxes

Tax withholding first occurred in the U.S. in 1862 at the order of President Abraham Lincoln to help finance the Civil War. The federal government also implemented excise taxes for the same purpose. Income taxes were abolished in 1872.

The implementation of the current system in 1943 was together with a big tax increase.

Back then, it was considered nearly impossible to collect taxes in the traditional way i.e., without withholding them from the source. The majority of workers have their income taxes deducted at the time of hiring when they submit a W-4 form. The form estimates the amount of taxes that will be due.

The withholding tax is one of two types of payroll taxes. The other type is paid to the government by the employer and is based on an individual employee’s wages. This money contributes to funding for Social Security and federal unemployment programs (since the Social Security Act of 1935) as well as Medicare (since 1966).

Types of Withholding Taxes

There are two types of withholding tax employed by the IRS to ensure that a proper amount is withheld in different situations: the U.S. resident and nonresident withholding tax.

U.S. Resident Withholding Tax

The first and more commonly discussed withholding tax is the one on U.S. residents’ personal income, which every employer in the U.S. must collect. Under the current system, employers collect the withholding tax and remit it directly to the government, with employees paying the remainder of what they may owe when they file a tax return in April each year.

If too much tax is withheld, the result is a tax refund. However, if not enough tax has been held back, then the individual will owe money to the IRS.

Generally, you want about 90% of your estimated income taxes withheld and sent to the government. This ensures that you never fall behind on income taxes (something that can result in heavy penalties) and that you're not overtaxed throughout the year.

Investors and independent contractors are exempt from withholding taxes but are required to pay quarterly estimated tax.

If these classes of taxpayers fall behind, they can become liable to backup withholding, which is a higher rate of tax withholding set at 24%.

You can easily perform a paycheck checkup using the IRS's Tax Withholding Estimator. This tool helps identify the correct amount of tax withheld from each paycheck to make sure that you don’t owe more when you file your annual return.

Nonresident Withholding Tax

The other type of withholding tax is levied against nonresident aliens to ensure that proper taxes are paid on income sources from within the U.S.

A nonresident alien is someone who isn't a citizen or national of the U.S. and hasn't passed the green card test or a substantial presence test.

All nonresident aliens must file Form 1040NR if they're engaged in a trade or business in the U.S. during the year.

If you're a nonresident alien, there are standard IRS deduction and exemption tables to help you figure out when you should be paying U.S. taxes and which deductions you may be able to claim.

If there's a tax treaty between your country and the U.S., that can also affect withholding tax

Calculating Your Withholding Tax

You can use the IRS Tax Withholding Estimator to calculate your withholding. In order to get an accurate figure, you'll need some basic information. Be sure to have the following handy while filling out the online form:

Your filing status

Your income source

Any additional income sources

The end date of your most recent pay period

Your wages per period and the year-to-date (YTD) totals

The amount of federal income tax per pay period and the total paid YTD

Whether you take the standard deduction or itemize your deductions

The amount of any tax credits you take

The estimator tells you how much of a refund or tax bill you can expect. You can also choose an estimated withholding amount that's suitable for you.

What Is the Purpose of Withholding Tax?

The purpose of withholding tax is to ensure that employees pay whatever income tax they owe. It maintains the pay-as-you-go tax collection system in the U.S. It also fights tax evasion and the need to send taxpayers big, unaffordable tax bills at the end of the tax year.

Why Did My Employer Withhold Too Much or Too Little Tax

Federal tax withholding is based on the information that you provide on your W-4 form, which you fill out and give to your employer when you start a job. If you're significantly overpaying or underpaying on income tax, you’ll probably need to revise this form with more up-to-date information. If an employer doesn't make adjustments to an employee's withholding, you might need to file IRS Form 843 to request a refund of the over-withholding.

Who Qualifies for Exemption From Withholding?

Employees with no tax liability for the previous year and who expect no tax liability for the current year can use Form W-4 to instruct their employer not to deduct any federal income tax from their wages. This exemption is valid for a calendar year.

Conclusion

Withholding tax is a tax deducted from your salary every month. This means you don't have to pay more tax in the end. You can use a calculator to find out the exact amount. Filling out the W-4 form correctly doesn't cause any problems and sometimes you get a tax refund.

Related Articles

Tax Refund Estimator Free – No Sign-Up Required

Use our Tax Refund Estimator Free tool to quickly calculate your potential tax refund. Fast, accurate, and easy to use for everyone

Income Tax Refund Estimator – Check Your Refund Online

Estimate your tax refund quickly with our Income Tax Refund Estimator. Get accurate results, understand deductions & credits, and plan your finances smarter.

Tax Refund Calculator – Estimate Your IRS Tax Refund for 2026

Use our Tax Refund Calculator 2026 to estimate your IRS tax refund quickly and accurately. Plan smarter, file with confidence, and maximize your refund.