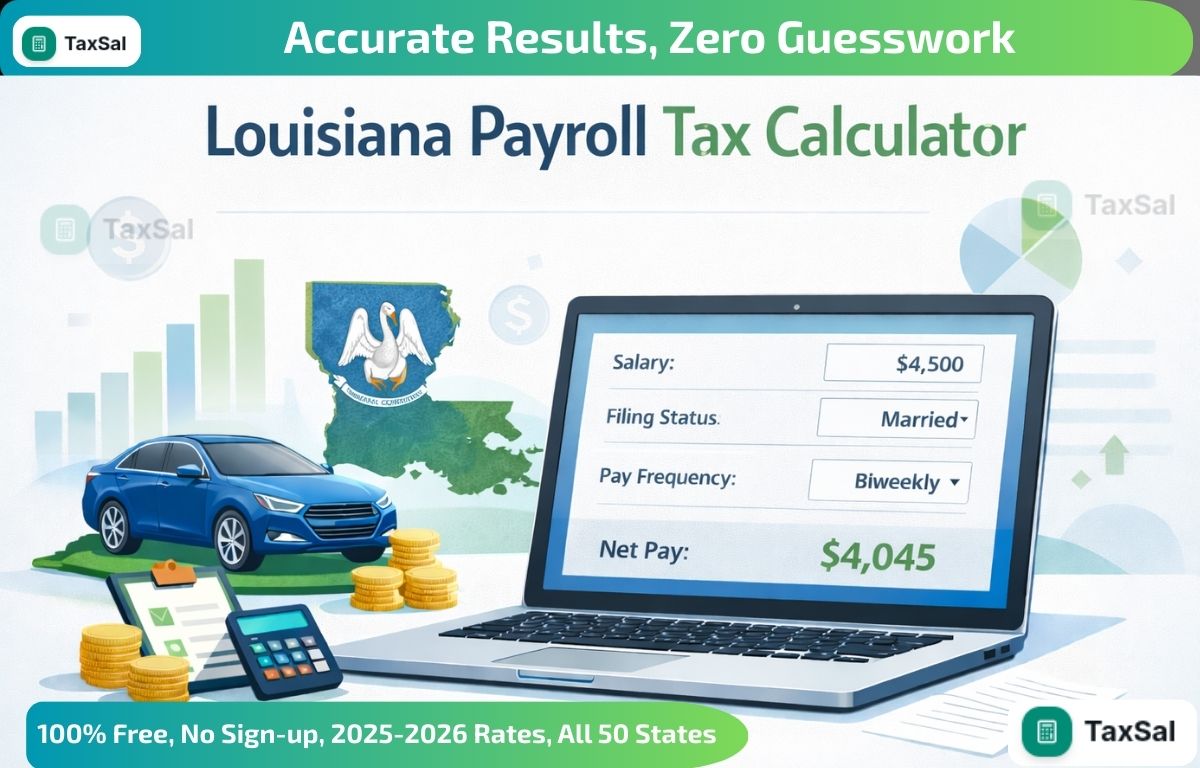

Louisiana Payroll Tax Calculator – Know Your Exact Take-Home Salary

Use the Louisiana Payroll Tax Calculator to calculate your exact take-home salary with accurate federal and state tax deductions in minutes.

Understanding your salary is more than just knowing your gross pay. If you live or work in Louisiana, your paycheck includes several deductions that directly impact how much money you actually take home. Federal taxes, state income tax, Social Security, Medicare, and other withholdings can significantly reduce your earnings. This is where a Louisiana Payroll Tax Calculator becomes an essential financial tool.

A payroll tax calculator helps employees, freelancers, and employers estimate their net pay accurately. Instead of guessing how much tax will be deducted, you can calculate your exact take-home salary in just a few clicks. In this article, we’ll explain how payroll taxes work in Louisiana, what deductions apply, and why using a calculator can save you time, money, and stress.

Check More: Louisiana Payroll Tax Calculator

What Is Payroll Tax?

Payroll tax refers to the taxes withheld from an employee’s paycheck by the employer. These taxes are paid to the federal and state governments and fund important public programs. Payroll taxes are not optional, and every working individual in Louisiana is subject to them unless they qualify for a specific exemption.

Payroll taxes typically include:

Federal income tax

Louisiana state income tax

Social Security tax

Medicare tax

Any additional deductions, such as retirement contributions or insurance

To understand these deductions clearly, a Louisiana Payroll Tax Calculator provides a transparent breakdown of each component.

Overview of Louisiana Payroll Taxes

Louisiana has a progressive state income tax system, meaning higher earners pay a higher percentage of tax. Unlike some states, Louisiana does not have a flat tax rate. Instead, your income is taxed in brackets.

In addition to state tax, employees must pay federal payroll taxes. Employers also share part of the tax burden, especially for Social Security and Medicare.

Using a Louisiana Payroll Tax Calculator ensures you account for both federal and state obligations correctly.

Louisiana State Income Tax Rates

Louisiana applies different tax rates depending on your filing status and income level. While the tax brackets may change over time, the state generally follows a low-to-moderate tax structure compared to other states.

Factors that influence Louisiana state income tax include:

Filing status (single, married filing jointly, head of household)

Total taxable income

Allowances and deductions claimed on Form L-4

Because these variables differ from person to person, manual calculation can be confusing. A Louisiana Payroll Tax Calculator automatically adjusts calculations based on your inputs.

Federal Payroll Taxes Explained

No matter which state you live in, federal payroll taxes apply to all U.S. workers. These include:

Federal Income Tax

This tax depends on your income, filing status, and W-4 allowances.

Social Security Tax

Employees pay 6.2% of their wages, while employers pay another 6.2%.

Medicare Tax

Employees contribute 1.45%, with employers matching the same amount.

A Louisiana Payroll Tax Calculator combines all these federal deductions with state taxes to give a complete picture of your paycheck.

Why You Should Use a Payroll Tax Calculator

Many employees rely solely on their employer’s payroll system and never check whether deductions are accurate. This can lead to overpaying taxes or receiving a smaller paycheck than expected.

Here’s why using a Louisiana Payroll Tax Calculator is highly beneficial:

It shows your exact take-home pay

It helps you plan monthly expenses

It allows you to compare job offers accurately

It helps freelancers estimate quarterly taxes

It reduces surprises at tax time

Knowing your net income gives you control over your financial future.

How to Use a Louisiana Payroll Tax Calculator

Using a payroll tax calculator is simple and user-friendly. Most online calculators ask for basic information such as:

Gross salary (hourly, weekly, or annual)

Pay frequency (weekly, bi-weekly, monthly)

Filing status

Number of allowances or dependents

Pre-tax deductions (if any)

Once entered, the Louisiana Payroll Tax Calculator instantly provides a breakdown of taxes and your net salary.

Payroll Tax Deductions That Affect Your Take-Home Pay

Several deductions can reduce your final paycheck amount. Understanding these deductions helps you avoid confusion.

Common payroll deductions include:

Health insurance premiums

Retirement contributions (401(k), IRA)

Life or disability insurance

Wage garnishments (if applicable)

A good Louisiana Payroll Tax Calculator includes optional fields to account for these deductions, making results more accurate.

Employers’ Role in Payroll Taxes

Employers are responsible for withholding and submitting payroll taxes on behalf of employees. They must follow both federal and Louisiana state laws.

Employers benefit from using a Louisiana Payroll Tax Calculator because it:

Reduces payroll errors

Ensures legal compliance

Saves administrative time

Improves employee trust

Accurate payroll calculations protect businesses from penalties and audits.

Payroll Taxes for Hourly vs Salaried Employees

Payroll taxes apply differently depending on whether you’re an hourly or salaried employee. Hourly workers may see variations in their paychecks due to overtime or varying hours, while salaried employees usually receive consistent pay.

Regardless of employment type, a Louisiana Payroll Tax Calculator adapts calculations based on your pay structure.

Freelancers and Self-Employed Individuals in Louisiana

If you’re self-employed, payroll taxes don’t disappear—they simply work differently. Freelancers must pay self-employment tax, which covers both the employee and employer portions of Social Security and Medicare.

Using a Louisiana Payroll Tax Calculator helps freelancers:

Estimate quarterly tax payments

Avoid underpayment penalties

Plan annual income more effectively

Planning Your Financial Future with Accurate Paychecks

Knowing your exact take-home salary empowers you to:

Create realistic budgets

Save for emergencies

Plan investments

Avoid unnecessary debt

When your paycheck is predictable, financial stress decreases significantly. This is why financial experts recommend regularly checking your earnings with a Louisiana Payroll Tax Calculator.

Conclusion

Payroll taxes can feel complicated, but they don’t have to be. With the right tools and information, you can easily understand how much money you truly earn. Whether you are an employee, employer, or freelancer, knowing your deductions is essential for financial clarity.

A reliable Louisiana Payroll Tax Calculator removes guesswork, saves time, and helps you stay financially informed. By using it regularly, you can confidently manage your income, plan expenses, and secure your financial future.

Related Articles

Tax Refund Estimator Free – No Sign-Up Required

Use our Tax Refund Estimator Free tool to quickly calculate your potential tax refund. Fast, accurate, and easy to use for everyone

Income Tax Refund Estimator – Check Your Refund Online

Estimate your tax refund quickly with our Income Tax Refund Estimator. Get accurate results, understand deductions & credits, and plan your finances smarter.

Tax Refund Calculator – Estimate Your IRS Tax Refund for 2026

Use our Tax Refund Calculator 2026 to estimate your IRS tax refund quickly and accurately. Plan smarter, file with confidence, and maximize your refund.