Maryland Withholding Tax Calculator – Accurate & Updated Payroll Estimates (2025)

Maryland Withholding Tax Calculator 2025 - Handling payroll taxes can be challenging for both employers and employees, especially when specific state guidelines are in effect.

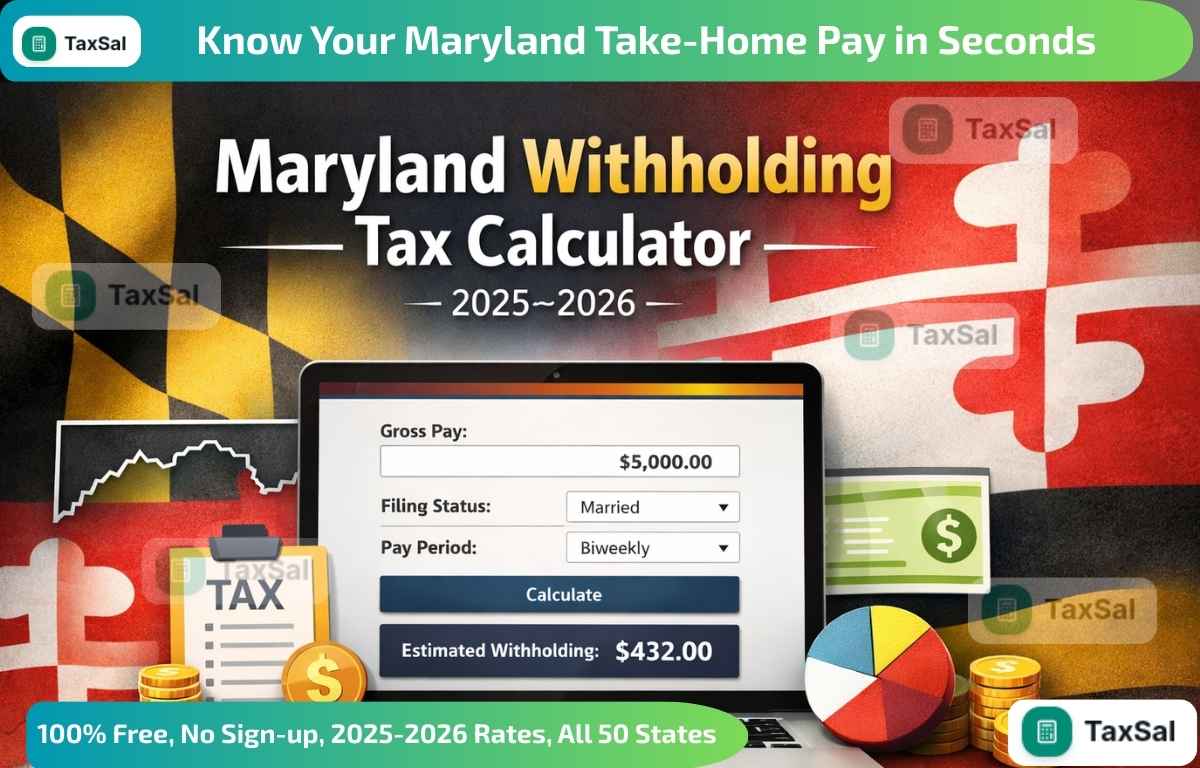

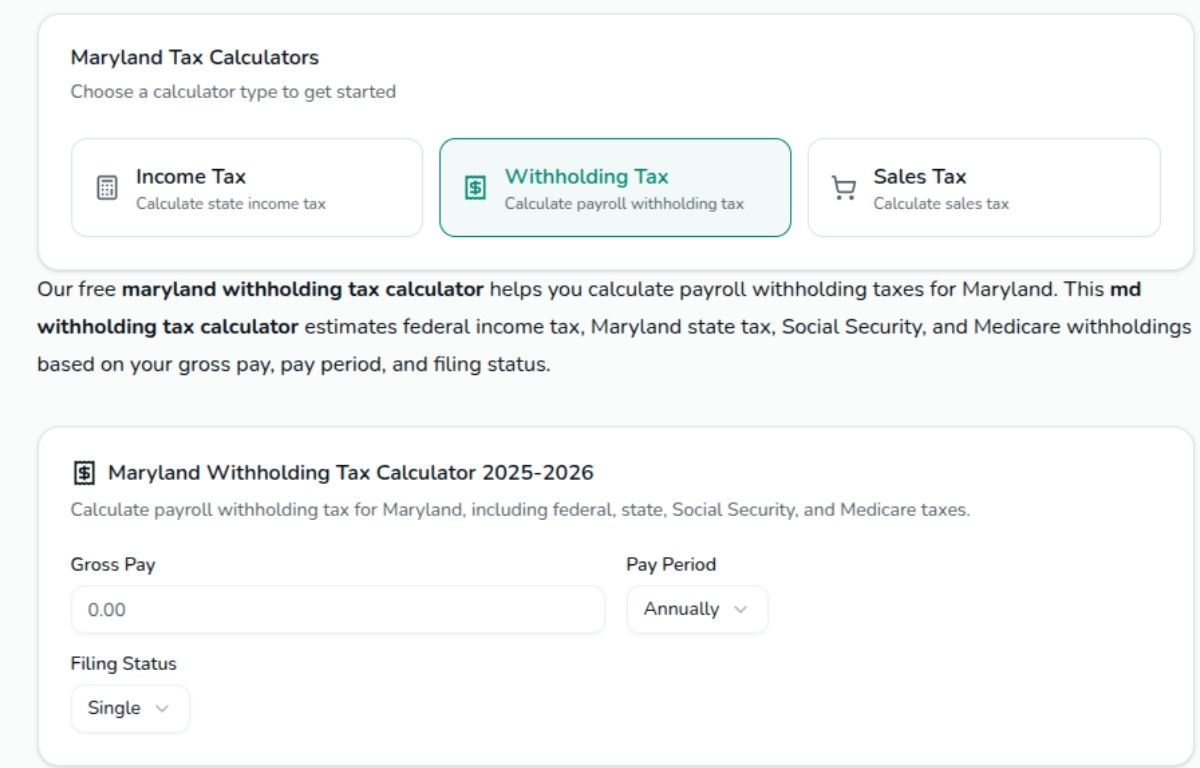

Maryland Withholding Tax Calculator 2025 - Handling payroll taxes can be challenging for both employers and employees, especially when specific state guidelines are in effect. The Maryland Withholding Tax Calculator (2025) is the tool that will work behind the scenes to make a tough job very simple by letting you precisely and quickly know how much state tax should be withheld from wages.

If you are an employer who does payroll or an employee who is just making sure his/her take-home pay is correct, then this guide will tell you all about the Maryland withholding tax and the role of a calculator in time-saving and error-prevention.

Check More: Maryland Withholding Tax Calculator

What Is Maryland Withholding Tax Calculator 2025?

Maryland Withholding Tax Calculator 2025 is the state income tax deducted from an employee’s paycheck by the employer. This amount is then submitted to the Maryland Comptroller on the employee’s behalf.

The withheld tax depends on several factors, including:

Gross wages

Filing status

Number of exemptions claimed

Additional withholding amounts (if any)

Maryland tax brackets and rates for 2025

Why should one utilize a Maryland withholding tax calculator during the year 2025?

Tax regulations and rates are frequently altered, so having a tax withholding calculator that reflects the latest regulations will give you a more accurate estimate for your taxes.

Among the primary advantages are:

Precise payment estimations

Adherence to Maryland tax regulations

Lower chances of tax withholding mistakes

Improved financial planning for workers

Quick and hassle-free payroll processing

How the Maryland Withholding Tax Calculator Operates?

This calculator is based on Maryland's tax rates and allows estimation of the withholding tax to be deducted from an employee's salary. To receive the correct amount you only have to provide basic payroll information, and the calculator will do the calculations for you.

The usual details that are given are:

Pay frequency (weekly, biweekly, monthly)

Gross pay amount

Filing status (single, married, etc.)

Number of allowances/exemptions

Additional withholding (optional)

The calculator then provides:

Estimated Maryland state tax withheld

Net (take-home) pay

Detailed payroll breakdown

Who Is This Calculator Intended For?

The Maryland Withholding Tax Calculator 2025 is beneficial for:

Employers – to calculate precise payroll and ensure legal compliance

HR & payroll managers – to mitigate manual calculation inaccuracies

Workers – to grasp gross pay deductions

W-2 income freelancers – to calculate tax impact

Accountants & bookkeepers – for speedy tax verification

Maryland Withholding Against Federal Withholding

It is essential to grasp that the Maryland Withholding Tax Calculator 2025 is different from the federal income tax.

Your paycheck may have some deductions for:

Federal income tax

Maryland state income tax

Local county tax (if applicable)

Social Security & Medicare (FICA)

A good calculator helps you isolate state withholding while keeping the full payroll picture clear.

Common Mistakes to Avoid

Payroll issues, at times, result from trivial matters.

Prevent these typical issues:

Tax rates that are no longer applicable

Wrong deductions claimed

Maryland taxes are not considered

Calculating by hand instead of using a calculator

Withholding is not updated after life changes (such as marriage or a new job).

Final Thoughts

The Maryland Withholding Tax Calculator 2025 – Accurate & Updated Payroll Estimates (2025) is a must-have tool for the payroll and personal income planning people in Maryland. It is just that the software is very user-friendly, but it also flawlessly deals with complex tax regulations and ensures the precise meaning of all withholding figures.

When you use the calculator, you can pay less attention to the tax calculations and gain more in business or finance management with a relaxed mind.

Related Articles

Income Tax Refund Estimator – Check Your Refund Online

Estimate your tax refund quickly with our Income Tax Refund Estimator. Get accurate results, understand deductions & credits, and plan your finances smarter.

How the New York State Income Tax Withholding Calculator Helps You Estimate Accurate Taxes

Using current tax laws and progressive tax brackets, the New York State Income Tax Withholding Calculator on TaxSal is a comprehensive online tool that assists taxpayers in estimating their net take-home pay and state income tax liability. It turns a complicated tax calculation procedure into a user-friendly interface so that both professionals and laypeople can see how different inputs impact tax results.